ev tax credit 2022 retroactive

August 11 2022. The Internal Revenue Service IRS and US.

Ev Charging Tax Credit Returns Retroactive Ev Support

Note that this list is not written in stone and will change with the phase-in of other.

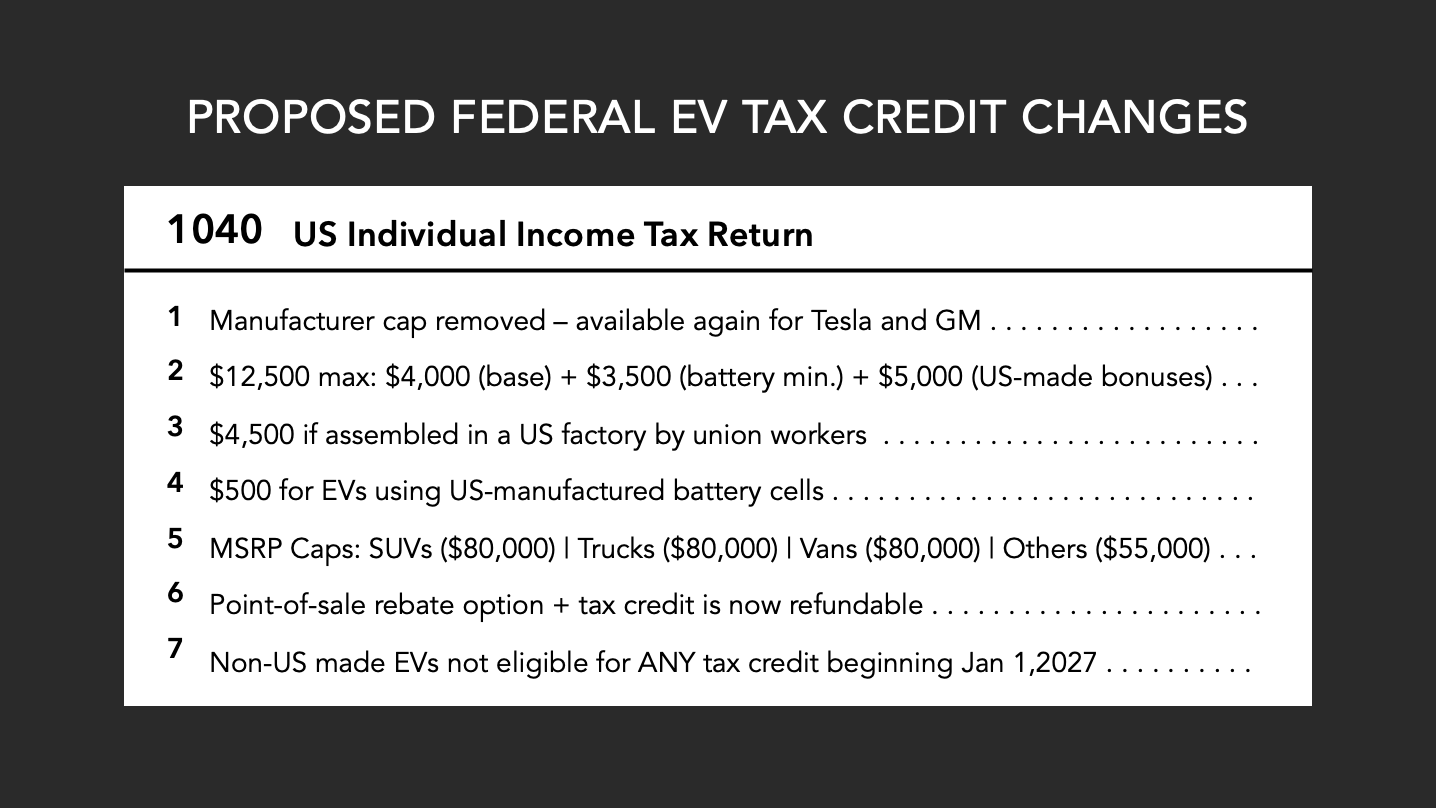

. US congressional leaders have agreed to a bill that would expand the existing 7500 new EV tax credit while introducing the first federal tax credit for used EVs. Buy now to claim the 7500 federal EV tax credit before it expires for 2022. Bengt Halvorson August 12 2022 Comment Now.

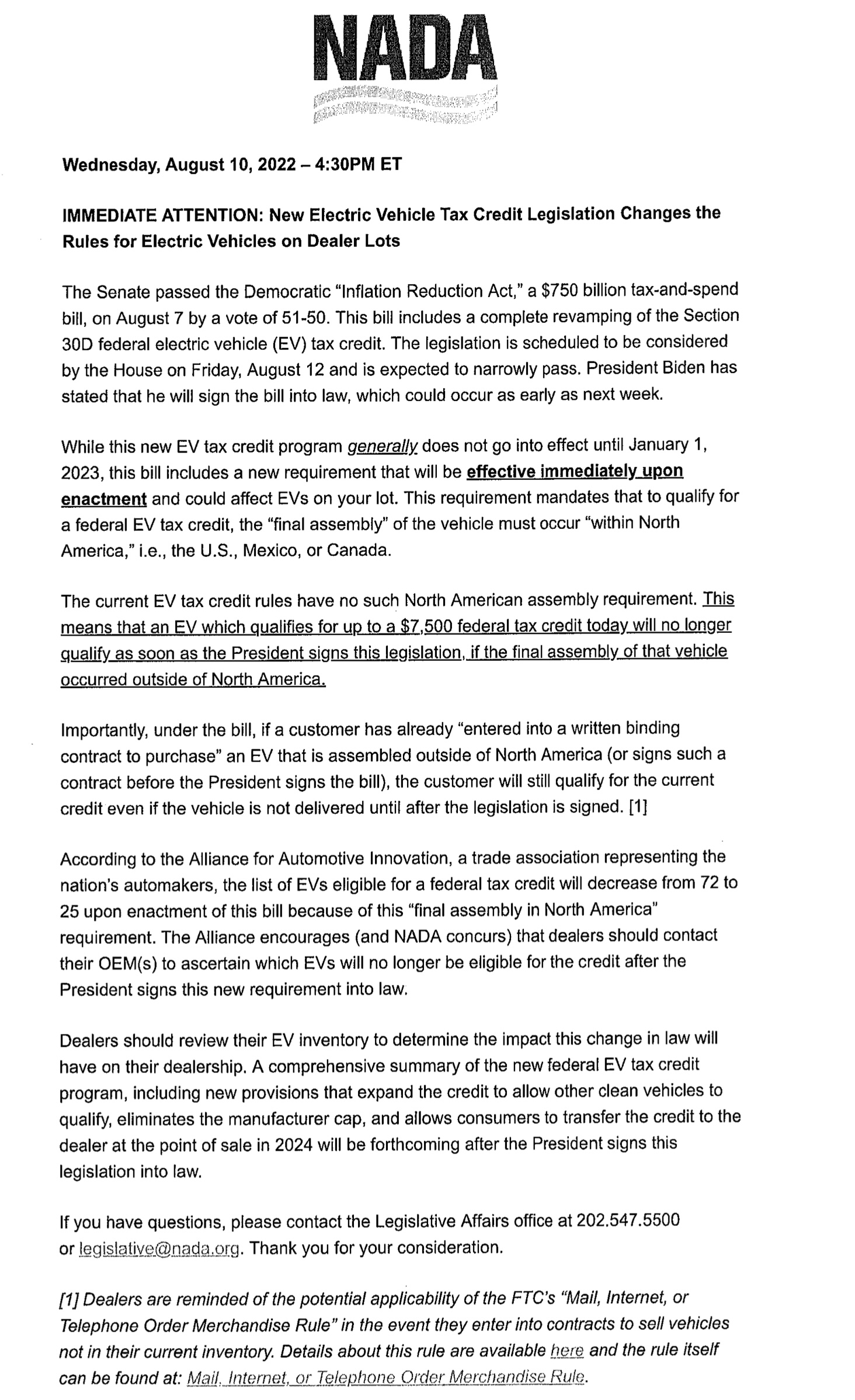

For 2021 taxes filed in 2022 the fully refundable Child Tax Credit is 3000 for children under age 18 and 3600 for children. 2022 EV Tax Credit Changes. Inflation Reduction Act extends 7500 tax credit but with price income caps Published Wed Aug 10 2022 905 AM EDT Updated Wed Aug 10 2022 1059 AM EDT Sarah.

Between our federal electric vehicle tax credit breakdown and the details above you. If you want to get a new electric vehicle this year. 2500 for purchase 1500 for lease.

Stephen Edelstein October 6 2022 Comment Now. If youre wealthy and you want to use the EV tax credit 2022 is the time to buy. The incentives had been proposed to.

Used clean vehicles will now be eligible for a credit of up to 40. However the answer as to whether or not the EV tax credit will be retroactive may not be as straightforward as you think. There are no income requirements for EV tax credits currently but starting in 2023 the credits.

Under current regulations buyers of electric vehicles get a 7500 tax credit when purchasing an electric vehicle but that full credit is limited to the first 200000 electric vehicles. Jeep Wrangler PHEV. The EV tax credits that are being proposed for 2022 are larger and more robust than previous and current electric vehicle tax credits.

Treasury Department are seeking public comment on draft rules for the revised. However the signing of the Inflation Reduction Act. The House is expected to pass it.

The federal EV tax credit will change if the Inflation Reduction Act is signed into law. With the renewed Alternative Fuel Vehicle Refueling Property Tax Credit businesses can again receive a 30 tax credit up to 30000. What Is the Electric Vehicle EV Tax Credit.

Updated information for consumers as of August 16 2022 New Final Assembly Requirement If you are interested in claiming the tax credit available under section 30D EV. The Alternative Fuel Infrastructure Tax Credit. How the EV tax credits in Democrats climate bill could hurt electric vehicle sales Published Wed Aug 10 2022 1055 AM EDT Updated Wed Aug 10 2022 309 PM EDT.

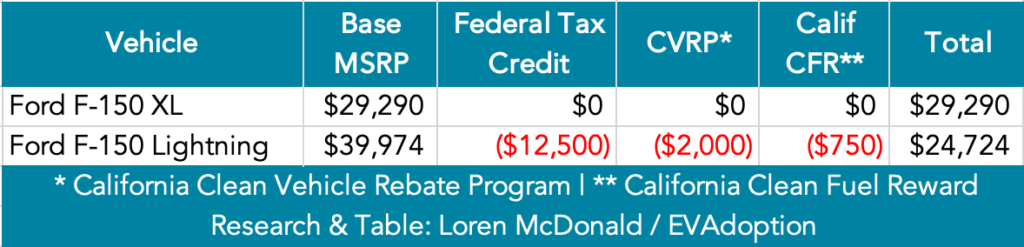

Since the US added EV tax. The EV tax credit proposed by Biden and other Democrats would be an increase from the current 7500 credit to a maximum of 12500. They have previously been excluded from any form of the EV tax credit but will now be eligible for partial credit.

However only specific types of. With the recent breaking news about EV tax credits included in the Inflation Reduction Act of 2022 there has been a lot of misinformation spreading on socia. First and foremost for EVs placed into service after December 31 2022 the Inflation Reduction Act extends the up to 7500 EV tax credit for 10 yearsuntil December.

Based on how the federal EV tax credit currently. It has already been passed by the Senate. Until recently many EVs were eligible for a 7500 tax credit.

A tax credit on used vehicles worth either 4000 or 30 of the used EVs sales price whichever is lower will be available on used models costing less than 25000.

The New Ev Tax Credit In 2022 Everything You Need To Know Updated Yaa

Ev Charging Equipment Tax Credit Extended Solar Electric Contractor In Seattle Wa 206 557 4215

Proposed Changes To The Federal Ev Tax Credit Passed By The House Of Representatives Evadoption

Ev Tax Credit 2022 Changes How It Works Eligible Vehicles Carsdirect

Buy Now To Claim The 7 500 Federal Ev Tax Credit Before It Expires For 2022

Chevy Bolt Ev Bolt Euv Buyers To Get Retroactive Discount

The Definitive Ev Tax Credit Guide

Us Announces Retroactive Subsidy Extension Electrive Com

Ev Tax Credit 2022 Changes How It Works Eligible Vehicles Carsdirect

Inflation Reduction Act Revives Hope For Biden S Climate Agenda

3 Ways The Inflation Reduction Act Would Pay You To Help Fight Climate Change Twitter

Ev Tax Credit Deal Unintended Consequences Alarming Grid Situation Ford Earnings Call Youtube

Are Ev Tax Credits Retroactive Carsdirect

Proposed Changes To The Federal Ev Tax Credit Passed By The House Of Representatives Evadoption

Ev Tax Credit Expansion Deal Reached By Senate F 150 Lightning Forum For Owners News Discussions

Ev Tax Credit Boost At Up To 12 500 Here S How The Two Versions Compare

Ira Consumer Incentives Fact Sheets Winneshiek Energy District